Zameen - An Emerging Market Marketplace

Frontier Digital Ventures (FDV) owns several leading marketplaces

TLDR

Marketplaces are great businesses. Dominant marketplaces are extremely profitable. Zameen is a dominant real estate marketplace in Pakistan with significant pricing power.

Pakistan is the world’s 5th most populous country, with a fast-growing economy, and significant demand for housing. Pakistan’s real estate market has decades of growth ahead, from trends such as urbanization, a 10-12m housing shortage, and a reduction in household size.

Zameen has significant room for growth as it continues to penetrate Pakistan’s mostly analog real estate market. Zameen will also benefit from the long-term structural growth in Pakistan’s housing market.

FDV owns 30% of Zameen and several EM marketplaces. FDV is free cash flow positive and the current market valuation significantly undervalues its assets.

Marketplaces

Marketplaces are where buyers and sellers meet and they generally facilitate a lot of economic activity. Marketplaces can vary from a simple physical location to shopping malls, or stock exchanges. Marketplaces that can capture some of the economic value they are facilitating can become very profitable businesses.

When you think of a typical business, they have to source supply (i.e., retailers need inventory, banks need capital, software companies need software) and then find the customers who demand that supply (i.e., distribution, sales, advertising). The amount of power a business has over its suppliers and customers goes a long way in determining its profitability. Dominant marketplaces do not have to haggle for supply or demand, but they become the de facto destination for supply and demand. This is why established online marketplaces are extremely profitable businesses with a lot of pricing power.

To illustrate this dynamic, let’s look at Airbnb which is the world’s leading marketplace for unique holiday rentals. They dominate both the demand and supply side in this market as their platform has reached verb status among consumers and they have over 6m unique listings on their platform. At Airbnb’s inception, they had to spend a lot of money on Sales and Marketing to acquire both users (demand) and hosts (supply). This can be costly and capital intensive, which is why as of 2019 Airbnb had generated cumulative losses of $1.4b since its inception. However, in 2022 alone Airbnb generated $3.4b in free cash flow, which was more than their total cumulative pre-COVID losses. The chart below shows the extreme profits that a marketplace can generate once it becomes dominant, with ABNB generating a 5x return (gross profits) on S&M in 2022.

I’ve included a list of leading online marketplaces below. As you can see, the group has more revenue growth (pricing power), higher margins, and higher returns (profitability) than most other businesses. The group has a median Rule of 40 of 47 and a Return on Capital of 20%. This compares the average company in the S&P 500 with a Rule of 40 of 14 and a 9% Return on Capital. Some of the most dominant and profitable marketplaces tend to be in travel, property, and auto markets. Travel marketplaces have been highly profitable given the global scalability of the vertical, while property/auto classifieds are regional and very hard to unseat once they become dominant.

Introducing Zameen – a dominant marketplace

Zameen is Pakistan’s leading online property marketplace. Zameen has a monopoly position in Pakistan and is set to continue to benefit from long-term structural trends such as the growth of Pakistan’s economy and housing market, urbanization, and internet penetration. Before touching on Zameen’s business model and market position, I'd like to dive into some of the features of Pakistan’s economy, the housing market, and some of the issues facing the country.

Pakistan’s Economy & Property Market

Pakistan’s Economy

Pakistan is the world’s fifth most populous country, with a fast-growing population and economy. Pakistan’s population is expected to grow by 20% over the next 10 years, which should underpin its economic growth.

In addition to strong levels of population growth, Pakistanis have also benefitted from a growing economy with real GDP per capita accelerating to 2.5% per year over the last decade, which compares to 1.9% over the previous decade.

This increased prosperity is due to the growth and sophistication of Pakistan’s textile industry and the growth in their services exports (i.e., IT services). For instance, 20 years ago non-retail quality cotton was Pakistan’s largest goods export, whereas today value-added products like suits, knitwear, and house linens are Pakistan’s largest exports.

While there are some near-term risks to the Pakistan economy, over the long-run population growth is generally the key factor that drives economic growth. Pakistan should also be a beneficiary of the trend to diversify supply chains (away from China). Furthermore, as China’s manufacturing base continues to age, Pakistan should stand to benefit given its established expertise in textiles.

Pakistan’s Property Market

Pakistan’s property market presents an attractive long-term investment opportunity. Pakistan has a fast-growing population and is in the early stages of urbanization (~60% rural population). There are 35-38m households in Pakistan (~6-7 people per household) and there are typically 250-300k homes built each year (0.8% housing stock growth), significantly under-indexing the 2% population growth. As a result of these trends, Pakistan has a growing housing shortage of 10-12m homes.

Due to long-term structural trends such as urbanization, population growth, and the shift away from multi-generational households, Pakistan’s real estate market should continue to experience decades of growth. The bulk of Pakistan’s housing demand is in the new build segment (primary market), and they are generally multi-residential apartments. This development trend is similar to the trends seen in places like China.

One key feature of Pakistan’s property market is that it is not as reliant on mortgage financing, with household debt only 3% of GDP. Therefore households are not as interest rate sensitive, unlike developed markets with highly indebted households. Most new home developments in Pakistan operate on an instalment plan, where buyers pay down in instalments, with the building process tracking the instalments. This process can take years.

The lack of access to capital can help explain the severe housing shortage in Pakistan. As the Pakistan economy continues to develop, and if their citizens can begin accessing capital to fund their homes, this could light a fire under Pakistan’s housing market and would present a generational growth opportunity (i.e., like 2000s China).

Risks - A lot is going wrong at the moment

The key issue with Zameen is that there are multiple economic and political risks within Pakistan. While Zameen’s business is structurally sound, these broader economic factors make Zameen a high-risk investment.

Pakistan might go bankrupt

Pakistan’s government is at risk of default, which has placed significant pressure on its currency and reserves, pushing up inflation. While I am no political / credit expert - and Pakistan defaulting is a risk for Zameen - I believe this is not a long-term structural issue. Many countries have gone bankrupt and lived to tell the story. For instance, Germany has been bankrupt 8 times, while half of the countries in Europe have been bankrupt at least once. More recently, countries like Iceland (2008), Argentina (2001), and Mexico (1982) experienced bankruptcy. These countries were able to restructure their debt, and their economies have grown post-bankruptcy.

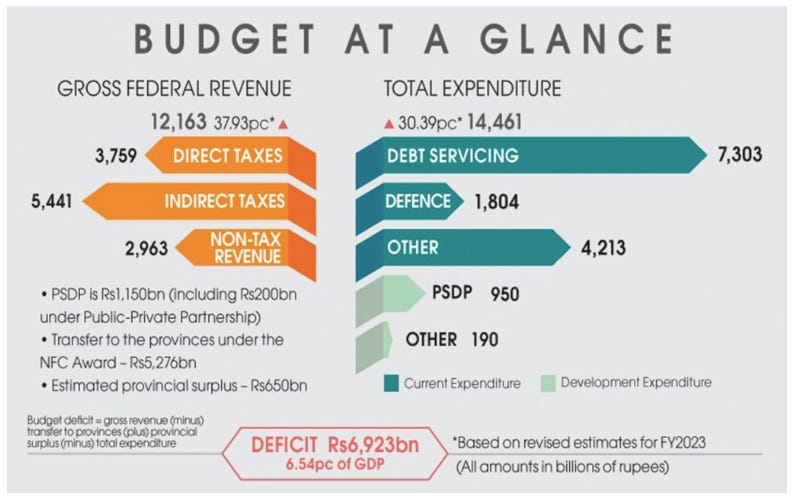

Interest payments on government debt make up 50% of Pakistan’s total expenditures and are greater than their total deficit. This makes me believe that there is a path forward if they were able to restructure their debt.

The one ace that Pakistan has up its sleeve is that it’s a nuclear power. One advantage of being a nuclear power is that those countries, particularly smaller economies, can get easier access to capital. World powers and neighboring countries get zero benefits from witnessing a nuclear country collapse and nuclear codes fall into the hands of potentially unstable individuals. As a result, struggling countries that possess a nuclear arsenal tend to get easier access to foreign capital and grants. We have seen this repeatedly with regard to North Korea. China continues to be North Korea’s largest financial sponsor and aid provider, as China has no interest in seeing the regime collapse, experiencing turmoil at their border, and potentially having to deal with an even more unstable leader. Similarly for Pakistan, despite experiencing significant fiscal imbalances, Pakistan has continued to receive backing from its largest lenders, (China & Saudi Arabia), while the IMF recently extended further capital to Pakistan.

Political Turmoil

The other risk within Pakistan at the moment is political turmoil. Former President, Imran Khan, was recently arrested and there have been violent clashes between his supporters and the state. While political turmoil is not uncommon in the region (1999 non-violent coup), the clashes have since subsided.

Property Market

Due to the above risks and high levels of inflation, the property market has been under pressure. While higher interest rates are not directly impacting demand (i.e., low mortgage penetration), the backdrop has significantly impacted property market sentiment. While Pakistan’s property prices are still rising, activity is slowing. Zameen saw their 1Q23 revenue fall 21% due to lower levels of activity.

Why Zameen - what’s the opportunity?

I might have laid out a compelling case to avoid investing in Zameen and Pakistan! While I recognize that the near-term backdrop isn’t great, many factors make Zameen an attractive investment.

Zameen is a dominant digital marketplace with high levels of pricing power. Zameen has significant room for growth as Pakistan’s real estate market continues to digitize (only 21% internet penetration), and as Pakistan’s housing market continues to grow. Due to these strong structural tailwinds, Zameen has grown at a 64% CAGR over the last 5 years and is profitable and free cash flow positive. Due to its market position and internet economics, Zameen should be in a good position to weather the near-term headwinds (1Q23 revenue -21%, Costs -20%).

Zameen’s Dominance

Zameen has a stronger market position than most of the other dominant property marketplaces. When assessing online property classifieds, the most important factor that determines dominance is its audience. While marketplaces need to balance supply and demand, as advertising businesses, their online audience (i.e., users, engagement, brand strength) is the most important factor that determines their competitive advantage and pricing power. Advertising dollars always follow the eyeballs.

As shown in the chart below, Zameen is extremely dominant, with a 30x traffic lead to its nearest competitor Lamudi (FYI - even though Graana has more traffic than Lamudi, my research indicates Lamudi is the true no.2 as Graana’s traffic is very low quality/inflated). Google Trends also indicates the massive branding advantage Zameen has over its competitors.

For comparison, realestate.com.au (one of the world’s most valuable property portals) has a 3.3x traffic lead over its nearest competitor. UK’s Rightmove has a 2.9x traffic advantage over Zoopla, while the US’ Zillow has a 2.3x lead over Realtor.com. This further shows the extent of Zameen’s dominance within its market.

While looking at traffic metrics are important, it is also important to assess the quality of traffic. Zameen’s traffic quality also mirrors that of the leading marketplaces (i.e., higher engagement = higher quality traffic). While Zameen is already profitable, its dominant market position and engagement should enable them to be a very profitable business at scale.

Pricing Power - How does Zameen make money?

Zameen makes money by advertising properties on behalf of property developers, owners, and leasing agents. As previously highlighted, the bulk of Pakistan’s housing demand is in the new build segment. Zameen makes the bulk of its money (85%) by facilitating sales of new developments and apartments. Zameen also dominates the resale market, however given the lifecycle of Pakistan’s property market, this remains a small part of their business. This dynamic is uniform across most emerging/growing markets.

Zameen has established a really powerful transaction monetization model early in its lifecycle. Many property marketplaces are trying/tried to transition into a transaction model.

Marketplaces that can facilitate direct transactions can demand a much higher fee (i.e., bringing a direct sale is more valuable than bringing a lead). To put this into perspective, Australia’s realestate.com.au charges A$1,500-3,000 for their highest value property ad, while Zameen made A$8,300 (1.2m rupees) per transaction in CY22, which equates to 5% of the average home price in Pakistan. It is important to note that Zameen are just facilitating these transactions, they are not home flippers.

Zameen has two products for the primary market:

General Advertising Package: Zameen acts as a general advertising channel, advertising the project across its platform and then passing off the leads to the developer.

Transaction Package: This is a 360-degree package where Zameen will become the outsourced sales agent for the developer, conducting everything from advertising to property tours and closing sales. Zameen uses a mix of in-house and outsourced personnel to complete these processes. Zameen usually has exclusivity for these projects, and can also outsource a portion of their volume to 3rd-party brokers who would keep a portion of the commission. Zameen charges 10-15% of the final sale price.

Zameen’s market position and success rates are what allow it to charge a premium vs traditional marketing companies and brokers, who would try to charge 5-7% of a property’s value but regularly fail to sell the project on time.

Why invest when the business is going backward?

While Zameen’s revenue will go backward in 2023, I believe investors should look through the current cyclical weakness for several reasons:

The current weakness within Pakistan’s housing market is cyclical and will not structurally change Zameen’s market position and pricing power.

Housing demand in Pakistan is not going away: the current risks are not systemic. Given the lack of mortgages in Pakistan, higher inflation and mortgage rates won’t cause systemic shocks to their market. Conversely, permanent 8-10% mortgage rates in places like AU/UK would cause systemic risks to housing.

The Pakistan housing market and Zameen’s best days are ahead of it, not behind it. Zameen is still in the early stages of growth and Pakistan’s housing market still has long-term structural demand. Whereas I can make the case that REA Group and Rightmove’s best days are behind it (i.e., fully penetrated, house prices are fully-loaded with debt, slowing population growth).

Zameen is free cash flow positive and is at a scale where it should be able to weather the storm. We saw this in Q1 when Zameen reduced their costs by 20% to offset revenue declines of 21%.

Pakistan’s housing weakness started in Nov-22, Zameen is 5 months away from lapping these softer comps.

The market has priced in a significant portion of the risk (see valuation below).

Zameen - what’s the opportunity?

Zameen’s strong revenue growth has been driven by their growth facilitating the sales of new developments.

I estimate that Zameen has increased its share of Pakistan’s new home sales from 0.2% in 2016 to 3.3% in 2022, up 17x. Given this low level of penetration and Zameen’s market position, Zameen has a long runway of growth.

Scenario #1 - Terminal 30% penetration

In 2022 Zameen facilitated 3.3% of the new homes sold in Pakistan. If we assume Zameen eventually gets to a 30% market share of new home builds, Zameen would generate A$541m in revenue. On this basis, I estimate that Zameen would be worth over A$3.7b.

Scenario #2 - Steady ramp

This scenario assumes Zameen slowly ramps up its penetration over the next decade and achieves a 10% penetration of new home sales. On this basis, Zameen would be worth A$3.1b, equating to A$819m today (ignoring the cash generated between CY23-32). Due to the current headwinds, I model CY23 revenue to decline 37%.

How to invest in Zameen?

While Zameen is a private company, there is an ASX-listed company called Frontier Digital Ventures (FDV AU) that owns 30% of Zameen. FDV owns several emerging market marketplaces, predominantly focused on Real Estate and Automotive verticals. FDV’s current portfolio consists of 15 marketplaces that operate in 20 countries, across LATAM, MENA, and Asia. FDV has complete ownership of most of its key assets, while they own 30% of its crown jewel, Zameen.

FDV was founded by CEO Shaun Di Gregorio, who owns ~9% of the company. Shaun is an experienced internet executive and previously worked at REA Group, leading their international / emerging markets strategies.

Valuation - Potential for a lot of upside

FDV’s current enterprise value is A$154m, and below I back solve for Zameen’s implied valuation. If I assume 2x revenue (i.e., 20% normalized margin / 10x earnings) for FDV’s larger/profitable businesses and 1x revenue for the rest, the implied valuation of Zameen is A$200m (FDV’s 30% share $59.7m) or 2.4x sales or 13x EBITDA. This valuation compares to Zameen’s most recent funding round where it was valued at US$400m (A$526m at 2020 FX rates) in Dec-20, equating to 13x revenue.

Using the two scenarios from above, I believe there is significant upside. Under Scenario 1, assuming Zameen hits its 30% penetration rate, the FDV share price could increase 7x from current levels (+620% upside). Under Scenario 2, the current valuation of the FDV share price should be $0.82, indicating +110% upside. While there are near-term risks, I think the current valuation of FDV factors in the majority of those risks and ascribes very little value to Zameen’s long-term growth potential, while also undervaluing FDV’s LATAM assets. If FDV continues to trade at current levels, I think it presents an attractive acquisition target for an internet-focused financial investor, or even Zameen’s majority shareholder (Dubizzle Group).

Other Considerations

Dubizzle Group (formerly EMPG Group) is Zameen’s largest shareholder. Dubizzle recently raised US$200m, led by Affinity, and is in the process of preparing to IPO their business. Alongside Zameen, Dubizzle owns four other EM marketplaces. The IPO of Dubizzle should present some sort of catalyst for FDV. In my view, Zameen is Dubizzle’s most attractive asset, and it makes sense for them to try and consolidate ownership before the IPO. Furthermore, Dubizzle is branding itself as the largest classifieds player in emerging markets, so in my view it would also make sense for Dubizzle to acquire FDV completely prior to IPO, as they would consolidate Zameen while also getting access to a large group of emerging market assets, giving them greater scale, a global presence, and more relevance as a listed business. They would also be completing this acquisition at a time when valuations are significantly depressed.

FDV’s Other Assets - while I have ascribed 2x sales for FDV’s 3 other large businesses, I believe it significantly undervalues them. For instance, InfoCasas (LATAM property) generates $20m in revenue and is currently growing double digits with a 4% EBITDA margin. Encuentra24 (Colombia property) is growing at double digits while maintaining an 11% EBITDA margin. It is unlikely that these businesses are worth only 2x CY22 revenue (i.e., 7-10x normalized earnings). Furthermore, the FDV Group (ex-Zameen) is also Free Cash Flow positive, which leaves the business in a great position.

Views are my own. This is not financial advice.